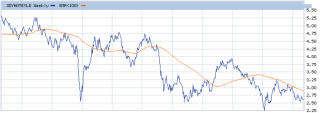

While pundits have claimed that there is just no more money to be made in bonds because rates are as low as they’ll go, rates keep dropping ever lower. Take the thirty year Treasury issue. In 2008, at the height of the Great Recession, the yield on this bond shattered US records by plunging to 2.50%. A rebound followed all the way up to 4.75%, only to see the bond revisit 2.50% again in mid 2012. Once again, there was a rebound, but weaker – to just shy of 4%. Then, in early 2015, the bond dropped all the way to 2.25%, breaking its old record. In fact, we saw the yield at 2.12% intraday back then. The ensuing rebound carried the yield to just 3.25%, well below the last high. Here’s what this progression looks like:

The economic circumstances that have led to the decline in yields are too complicated for this post, but suffice to say, they haven’t changed. The primary factor has been rising indebtedness here, in Europe, in China, in the oil patch, in public budgets, everywhere really – and that’s become worse, not better.

A colleague asked the other day, where do you think rates go from here? There we were, on the day of his question, in the lull of slightly under 3% on the long bond, and I didn’t really know what to say. We’ve been bullish on bonds for what seems like forever. Was that still justified?

Standing back, now, and looking at this trend which clearly shows lower highs and lower lows, and considering the pending bankruptcy of Puerto Rico, the continuing saga of Greece, the problems in Illinois, Atlantic City, and Hartford, and the patches applied in several California municipalities which will, sooner or later, come loose again – nothing has changed. In fact, things are worse – China has learned our bad habits and estimates say its debt exceeds 300% of GDP now, up tremendously from a very reasonable rate just a few years ago. Worse, defaults are rising. We all know China can rock the rest of the world.

Combine this with the fact that many other slow growth countries are experiencing negative interest rates. For a mind bender, consider that in Norway, some mortgage holders are getting checks from their lenders – rather than paying the bank for the house, the bank is paying them to own the house.

Those negative interest rates make our positive rates look mighty attractive, even at 2%. If buyers continue crossing borders to suck up our Treasury issuance, that will pressure yields downward still more.

My bet, then, is we head lower yet. You may one day have a shot at refinancing your home loan at 2%.