Choosing the Best Credit Card

A client asked us a simple question: What credit card is best for me? You would think this would have a handy answer, but alas, there are hundreds of credit cards on offer with thousands of permutations, the adverts for which all seem to end up in my mailbox at one time or another.

Card types are myriad; here are just a few.

- Airline miles cards

- Cash back/rewards cards, including several subcategories like for travel, groceries, etc

- No annual fee cards

- 0% APR (annual percentage rate, for when you do not pay off your balance) cards, which offer 0% interest for a time

- Sign up bonus cards, which offer you credit or cash for acquiring the card

Cards can have several of these features at once; for instance, many cards are giving sign up bonuses these days. There are plenty of other niche-y cards as well, including for business, store-specific, etc. But we’ll discuss just a few types here, responding to what most people want.

First, some basic background. A credit card is different from a ‘charge card’- the credit card features a revolving balance whereas a charge card must be paid off every month. On average, US customers carry four credit cards. If you have card accounts you don’t use, please terminate them. It’s too easy these days for hackers to take advantage of an account you are not monitoring. (Note that closing a card may affect your credit score, so don’t close five cards at once!)

Next, we’re going to assume you have excellent credit and will qualify for the best cards out there.

Finally, let’s get one more thing out of the way. We tend to dislike Discover and Capital One cards because in our experience, the initial spending limits are low, and obtaining higher limits is difficult. That said, feel free to check out Capital One Venture, which is its travel card. This card has several iterations which offer, variously, no annual fee, no foreign transaction fees, 0% APR for several months, and cash back rewards for travel. Travel must be booked through Capital One Travel, but there are no blackout dates or other restrictions that you might run into with air miles cards. Tricky part: booking through Capital One Travel might not be the best deal in town; if its prices are higher than, say, Expedia, it won’t matter how great your cash back rewards are – you might lose in higher travel prices. Another warning: from personal experience, I can say Capital One’s customer service leaves much to be desired.

Also, to be fair to Discover, it does have a highly rated cash back card, Discover It. No annual fee, various cash back percentages depending on where you spend, and a low APR. As a bonus, it has a US based customer service department which claims you can talk to a real person any time.

Many card families offer a ‘concierge’ card with a high annual fee, such as Chase Sapphire Reserve, that comes with help making dining reservations, insurance offerings, extra travel deals, and so forth. You can explore those on your own, but from our reading, the Chase Sapphire and American Express Platinum cards receive high marks. These have fees in the hundreds of dollars per year, so you better travel a lot!

If you want to obsess about points/miles and their value, please check out The Points Guy, at thepointsguy.com. The Points Guy puts an actual value on the bonus awards you might receive from a card. So if you’re the type to optimize everything in life, now you have a source for the credit card realm.

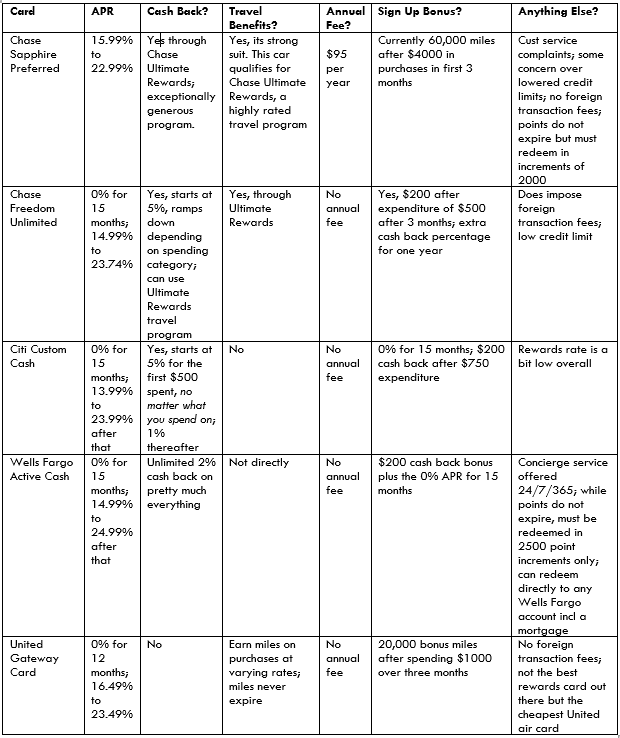

Moving on to the more popular choices among cards, the chart below gives recent offers from some of the more highly rated cards (we used ratings from the Motley Fool, Bankrate, Lending Tree, WalletHub, The Points Guy and others to come up with this compendium). We included just one air miles card – the one closest to what I use personally, but there are many out there, if you want to pile up miles on a specific airline.

Happy hunting!